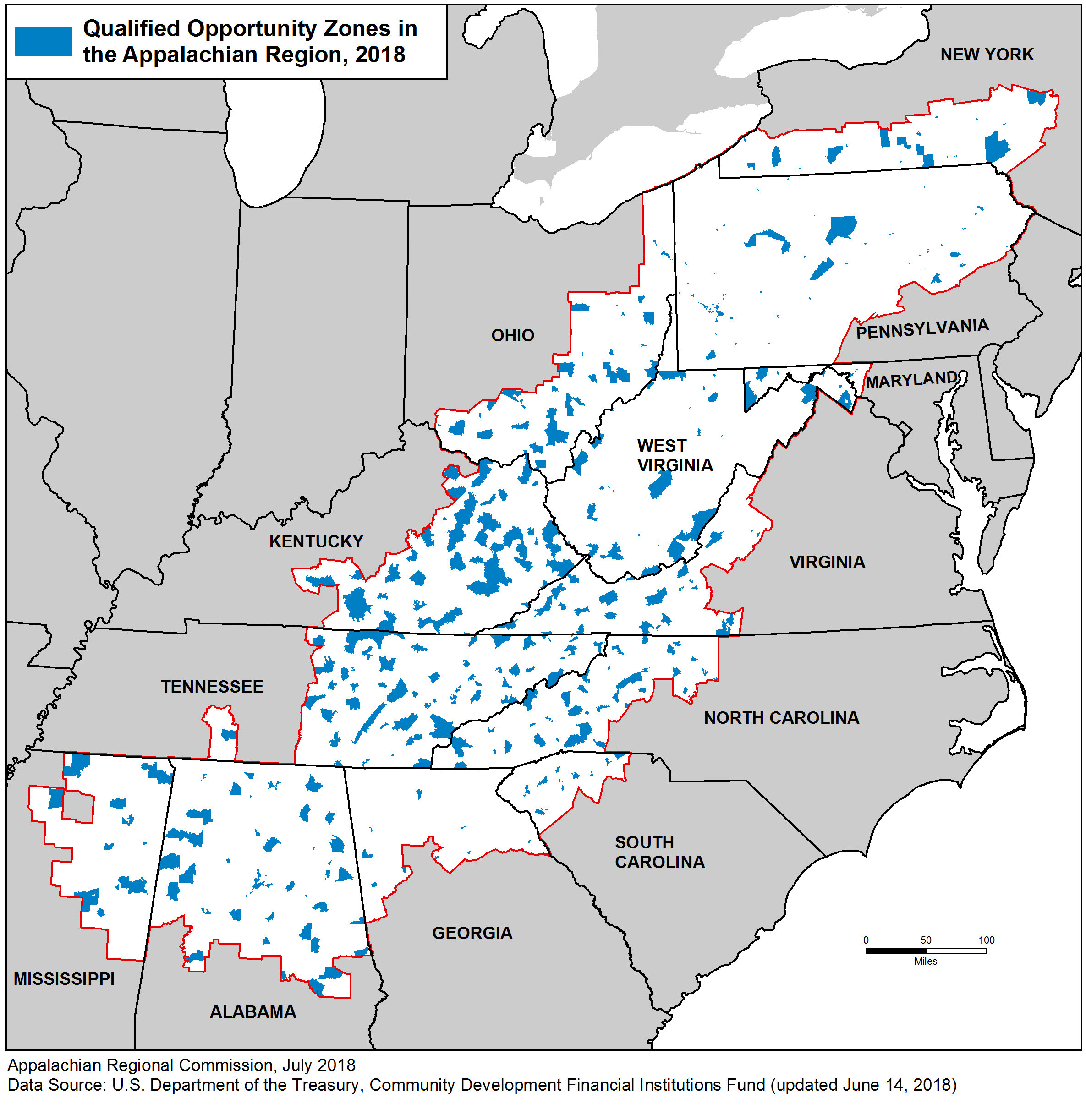

Opportunity Zones in Appalachia

The Opportunity Zone Initiative, approved by Congress and led by the President and his Administration, offers tax incentives designed to promote additional private investment in America's cities and towns. Opportunity Zones were created under the 2017 Tax Cuts and Jobs Act. As of July, 2018, 737 census tracts have been designated as Qualified Opportunity Zones across Appalachia. These eligible tracts are home to over 2.8 million Appalachian residents. Indeed, 8.5 percent of the nation's eligible tracts and 8.1 percent of its eligible population are located in the Appalachian Region. ARC's Federal Co-Chair serves on President Trump's White House Opportunity and Revitalization Council. What is an Opportunity Zone?An Opportunity Zone is an economically-distressed community where new investments, under certain conditions, may be eligible for preferential tax treatment. Localities qualify as Opportunity Zones if they have been nominated for that designation by the state, and that nomination has been certified by the Secretary of the U.S. Treasury via his delegation of authority to the Internal Revenue Service. Opportunity Zone eligibility is determined at the census tract level.How does ARC use Opportunity Zones?ARC encourages potential grantees to consider Opportunity Zones when designing project proposals.ADDITIONAL LINKS

|